Version 8 is a specialized ecommerce growth and marketing provider that has broken away from the traditional agency way of doing business. Instead of being a jack of all trades, they’ve opted to hone their skills in growing ecommerce businesses with a precision that agencies that cast a wide net simply can’t match. We connected with founder Jandre de Beer to get his unique insight on what it takes to help an ecommerce business scale fast and efficiently.

“You can build your ecommerce business around a ground breaking, game changing product, but if you don’t understand how to run an actual business, there’s no way you’ll succeed.” – Jandre de Beer, Version 8 Founder

How did Version 8 get started?

We started like any other agency: any client was the right client, as long as they could pay for our services! But it didn’t take us long to see that we were reacting to client problems instead of providing clients with a clear cut solution.

We used the insight we gained working with a variety of clients to find the niche that we felt comfortable in. Ecommerce solutions were an obvious choice, due to our experience with them, as well as rapidly growing demand thanks to many companies pivoting to ecommerce from their brick and mortar stores.

From there, we began to truly understand the ecommerce industry in its totality. By really honing in on every aspect of the ecommerce industry, we were able to develop a solution that streamlined the launching, running and growth of an online store. We found a way to keep our clients’ overheads as low as possible, whilst ensuring that profit margins allowed their businesses to scale.

By connecting with companies like Parcel Ninja to reduce our customers’ logistics costs, and online payment gateways like Peach Payments, we’re able to ensure that every cost an ecommerce business can incur is as low as possible.

What makes an ecommerce business viable to you?

We give our potential customers every possible reason why they shouldn’t be launching an ecommerce business, and if they can pass that test, we’ll partner with them. Naturally, a big part of that comes down to capital, because a lot of entrepreneurs don’t understand the costs involved.

You’ll find a lot of ecommerce businesses are founded because their creator has an existing skill or product; clothes, jewelry, gifts, and the like. They take their business online with high hopes, but no matter how good their product may be, their business isn’t going to be successful if they don’t know how to run a business! That’s why we’ll often jump on as business coaches as well. If we see something viable, we’ll give our clients the tools and training they need to make it in the ecommerce industry.

That’s really how we differ from traditional agencies. We’re not in it to build a site, launch a marketing campaign, and wish our customers good luck once the deal is done; a big part of our service is making sure our customers actually succeed.

Low profit margins result in many ecommerce businesses failing. In your experience, what’s a good margin for a viable ecommerce business?

30% or more for your product margin, i.e, your cost of goods versus what you’re selling them for. If you’re making thousands of sales, that margin becomes a little more flexible, but new ecommerce businesses rarely have that option or have the capital to run that model until they finally start producing the sales volume they need to keep the lights on.

You also have to consider how your marketing costs are reducing your profit margin. Social media marketing gets ever more expensive, and if you haven’t taken the time to develop an effective sales funnel, those clicks that turn into sales are likely to be once off purchases and if you want that customer to return, it’ll take another round of more expensive marketing that will eat away at your profit margin.

You need to increase the lifetime value of your customers; advertise once and provide an experience that keeps them coming back organically. Otherwise you need to continuously market to them which is going to eat away at your profit margins. Cover as many bases as possible. Collect a database and manually grow it, or even purchase it. Then of course there’s SEO to make sure that when customers are looking for products in your neck of the woods, you’re the provider that stands out.

If you’re not making that 30% or more on your sales, scaling becomes a tough challenge to overcome, and that’s what all entrepreneurs regardless of the industry have to keep in mind at all times.

How do you think about distribution costs and how do they affect your customers’ product margin?

You need to find every advantage you can. Most people only begin to think about logistics down the line and it ends up costing them money. By running in blind, they end up running at a loss, dealing with lots of costly returns, and damaging their brand.

The reason we partnered with Parcel Ninja is because they’re not associated with any one courier company. Different courier companies specialize in different parcel and location type deliveries. Parcel Ninja understands the various aspects of each parcel our customers will be sending and finds the most competitive quote among all the courier companies they partner with.

You can be good at what you do, have a great, in-demand product, and have a top of the line ecommerce store, but if you don’t understand how businesses run beyond making that initial sale, you’re bound to fail.

What’s your experience with integrating online payment gateways into your customers’ sites?

We’re still exploring what various payment gateways do right and what they do wrong. It’s tempting to stick with the earliest adopters because many of our clients are already signed up with them. But it is our duty to our clients to ensure they’re signed up with an online payment gateway partner that’s giving them the best service and most competitive fees, so the motivation to switch providers exists.

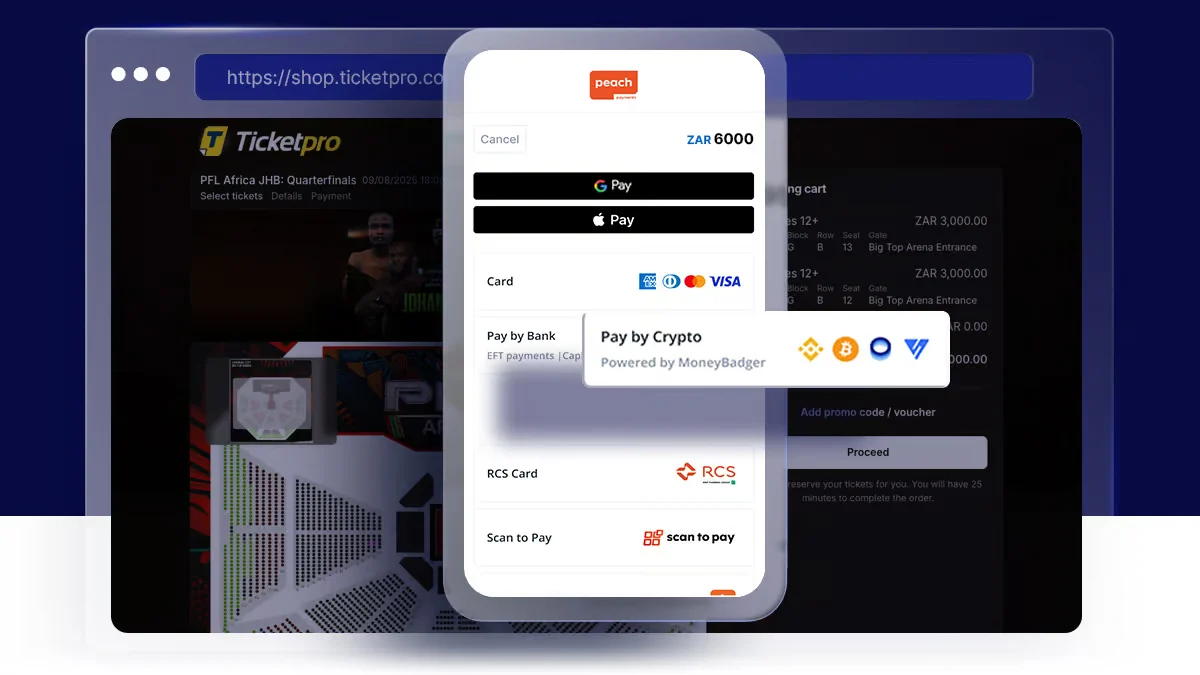

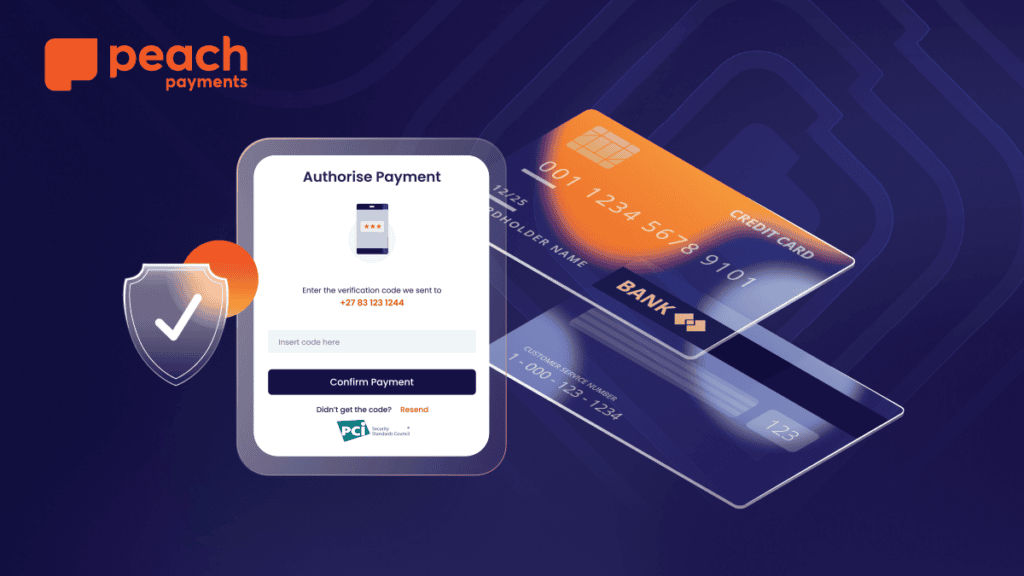

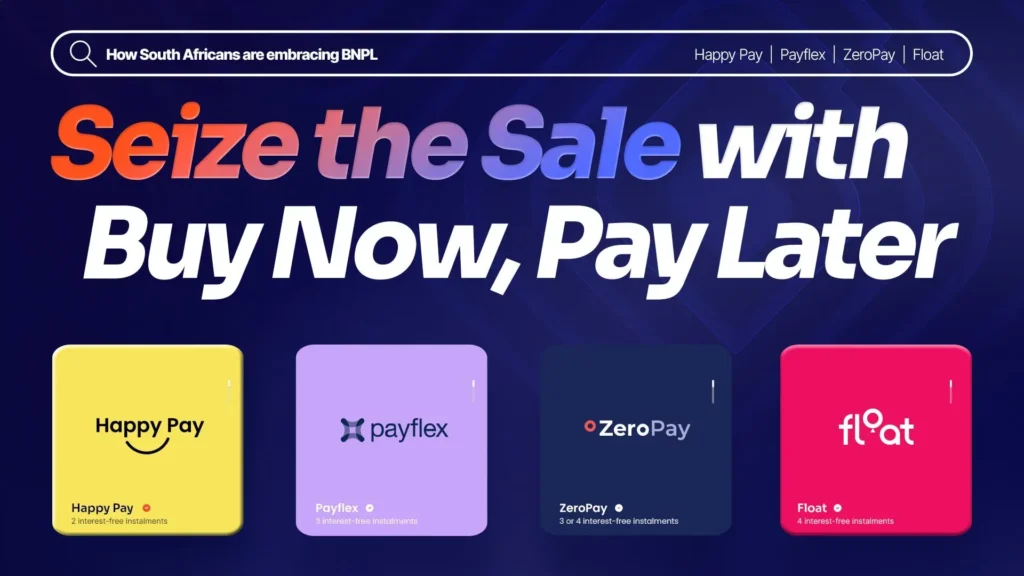

In the end, we really focus on conversion rates. There are still a lot of trust barriers to overcome in the South African market, so you need an online payment gateway that makes customers feel secure. That means great UX that doesn’t take the customer to a different URL as well as multiple payment options so that customers can choose which one they feel most secure using. If you aren’t ticking those boxes, there’s a good chance your customer is going to drop off at checkout.

What are your biggest online payment gateway pain points?

Conversion rates! There isn’t a more important metric. We re-engineer our entire sales funnels based on the data we collect. We go above and beyond to understand in as much detail as possible where exactly in the purchasing process customers are dropping off. South Africa is still catching up with the likes of Amazon and their 1-Click checkout system, which is why it’s nice to see Peach using tokenisation to enable recurring purchases and one-click checkouts. The seamlessness of the Peach checkout and the number of payment methods available certainly shows a focus on helping merchants maximise their conversion rates.